Do ESG Funds Deliver on Their Promises?

Corporations have received growing criticism for contributing to climate change, perpetuating racial and gender inequality, and failing to address other pressing social issues. In response to these concerns, shareholders are increasingly focusing on environmental, social, and corporate governance (ESG) criteria in selecting investments, and asset managers are responding by offering a growing number of ESG mutual funds. The flow of assets into ESG is one of the most dramatic trends in asset management.

But are these funds giving investors what they promise? This question has attracted the attention of regulators, with the Department of Labor and the Securities and Exchange Commission (SEC) both taking steps to rein in ESG funds. The change in administration has created an opportunity to rethink these steps, but the rapid growth and evolution of the market mean regulators are acting without a clear picture of ESG investing.

We fill this gap by offering the most complete empirical overview of ESG mutual funds to date. Combining comprehensive data on mutual funds with proprietary data from the several of the most significant ESG ratings firms, we provide a unique picture of the current ESG environment with an eye to informing regulatory policy. We evaluate a number of criticisms of ESG funds made by academics and policymakers and find them lacking. We find that ESG funds offer their investors increased ESG exposure. They also vote their shares differently from non-ESG funds and are more supportive of ESG principles. Our analysis shows that they do so without increasing costs or reducing returns.

We conclude that ESG funds generally offer investors a differentiated and competitive investment product that is consistent with their labeling. In short, we see no reason to single out ESG funds for special regulation.

Introduction

ESG investing—that is, investing informed by environmental, social, and governance criteria or considerations—is growing explosively.1Max M. Schanzenbach & Robert H. Sitkoff, Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee, 72 Stan. L. Rev. 381, 388 (2020) (explaining that ESG investing “is an umbrella term that refers to an investment strategy that emphasizes a firm’s governance structure or the environmental or social impacts of the firm’s products or practices”). Public attention in the United States and globally has increasingly focused on ESG issues,2See, e.g., Carlo Maximilian Funk & Suzanne Smetana, The New Normal: ESG Investing in 2021, NASDAQ (Jan. 9, 2021, 11:00 AM), https://www.nasdaq.com/articles/the-new-normal%3A-esg-investing-in-2021-2021-01-09 [perma.cc/Y4C6-UP8G] (explaining why global developments are likely to make ESG investing “the new normal”). and a growing percentage of investors consider green investing “a big priority.”3Michael Martin, Opinion, ESG: A Trend We Can’t Afford to Ignore, Fin. Times (Nov. 26, 2020), https://www.ft.com/content/87a922a1-8d60-4295-a9d8-d2c1ab5d788e [perma.cc/U9SD-2PBE]. In one of his first official acts, President Biden rejoined the Paris Agreement,4Nathan Rott, Biden Moves to Have U.S. Rejoin Climate Accord, NPR (Jan. 20, 2021, 5:45 PM), https://www.npr.org/sections/inauguration-day-live-updates/2021/01/20/958923821/biden-moves-to-have-u-s-rejoin-climate-accord [perma.cc/9PHQ-JJ6P]. and the Securities and Exchange Commission (SEC) has, for the first time, a designated policy advisor to advance ESG issues.5Jim Tyson, SEC Appoints Policy Advisor to Advance New Initiatives on ESG, CFO Dive (Feb. 2 2021), https://www.cfodive.com/news/securities-exchange-commission-esg-Satyam-Khanna-biden/594369 [perma.cc/T3QC-LNP2] (reporting Satyam Khanna’s appointment in a “newly created role as senior policy advisor for climate and ESG”).

The growing focus on ESG investing is reflected by the rapidly expanding number of mutual funds that purport to consider ESG factors in their investment and voting decisions, as well as a surge in the volume of assets invested in such funds. Morningstar reports that both the number of ESG-focused index funds and the total amount of assets held by such funds have doubled in the past three years.6Pippa Stevens, ESG Index Funds Hit 0 Billion as Pandemic Accelerates Impact Investing Boom, CNBC (Sept. 2, 2020, 9:25 AM), https://www.cnbc.com/2020/09/02/esg-index-funds-hit-250-billion-as-us-investor-role-in-boom-grows.html [perma.cc/BPP4-9QF2]. The COVID-19 pandemic and the disruptions it has caused to financial markets have done nothing to slow this rise.7Lubos Pastor & M. Blair Vorsatz, Mutual Fund Performance and Flows During the COVID-19 Crisis, (Nat’l Bureau of Econ. Rsch., Working Paper No. 27551, 2020), https://www.nber.org/system/files/working_papers/w27551/w27551.pdf [perma.cc/AS4U-9V57] (finding that ESG funds did well, in terms of both performance and fund flows, during the COVID-19 crisis of 2020); Deike Diers & Axel Seemann, Could Covid-19 Open More Doors for ESG Investing?, Bain & Co. (Aug. 26, 2020), https://www.bain.com/insights/could-covid-19-open-more-doors-esg-investing-snap-chart [perma.cc/KR27-DF7C] (arguing that the COVID-19 crisis is likely to accelerate the trend towards ESG investing).

But do these rapidly growing ESG funds deliver what they promise? Do ESG funds offer portfolios with real investment exposure to ESG goals or has the demand for ESG investing led to overpriced, greenwashed funds that are merely marketed as ESG to chase the latest investment fad?8See, e.g., Tariq Fancy, Opinion, Financial World Greenwashing the Public with Deadly Distraction in Sustainable Investing Practices, USA Today (Mar. 16, 2021, 4:02 PM), https://www.usatoday.com/story/opinion/2021/03/16/wall-street-esg-sustainable-investing-greenwashing-column/6948923002 [perma.cc/Y7Q9-K9D4] (“[S]ustainable investing boils down to little more than marketing hype, PR spin and disingenuous promises from the investment community.”). The answers to these questions have legal implications because mutual funds are extensively regulated by the SEC and the inclusion of mutual funds in retirement plans is regulated by the Department of Labor (DOL) under the Employee Retirement Income Security Act of 1974 (ERISA)9Employee Retirement Income Security Act (ERISA) of 1974, Pub. L. No. 93-406, 88 Stat. 829 (codified as amended in scattered sections of the U.S. Code).. In fact, both the SEC and the DOL have recently turned their attention to ESG investing.10The SEC solicited public comment on whether the use of “ESG” in mutual fund names is likely to mislead investors. Request for Comments on Fund Names, 85 Fed. Reg. 13,221 (Mar. 6, 2020). The SEC’s Office of Compliance Inspections and Examinations also expressed particular interest in the “accuracy and adequacy of disclosures provided by RIAs [registered investment advisors] offering clients . . . strategies focused on sustainable and responsible investing, which incorporate environmental, social, and governance (ESG) criteria.” Off. of Compliance Inspections & Examinations, SEC, 2020 Examination Priorities 15 (2020), https://www.sec.gov/about/offices/ocie/national-examination-program-priorities-2020.pdf [perma.cc/ZKQ9-SX3T]. For the SEC, the central legal question is whether funds that characterize themselves as focused on ESG deliver on that promise—do they invest and vote differently from other mutual funds?11See, e.g., Asset Mgmt. Advisory Comm., SEC, Update on Progress in ESG Subcommittee (2020), https://www.sec.gov/files/update-from-esg-subcommittee-09162020.pdf [perma.cc/GGU6-EUZX] (identifying “concerns about the potential for ‘greenwashing’ in ESG funds”). For the DOL, the question is whether ESG investing is consistent with the fiduciary duties of retirement plan trustees—do ESG funds deliver sound performance at reasonable cost or do they sacrifice returns to promote social causes?12See, e.g., Robert R. Gower, A Pecuniary Focus: Department of Labor Issues Final Rule on Financial Factors in Selecting Plan Investments, Trucker Huss (Nov. 12, 2020), https://www.truckerhuss.com/2020/11/a-pecuniary-focus-department-of-labor-issues-final-rule-on-financial-factors-in-selecting-plan-investments [perma.cc/9H6Y-AYY9] (“[T]he DOL has expressed increasing concern that a growing emphasis and interest in ESG investing may prompt ERISA plan fiduciaries to make investment decisions for motives other than their fiduciary duty to provide benefits to participants and beneficiaries . . . .”). Despite these differing concerns, both the SEC and the DOL view the growth of ESG funds as potentially warranting regulatory intervention. Indeed, the DOL has already intervened, adopting a new rule on November 13, 2020, that may deter 401(k) plans from offering ESG funds.13Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 72,846, 72,846 (Nov. 13, 2020) (to be codified at 29 C.F.R. pt. 2509, 2550) (“A fiduciary’s evaluation of an investment or investment course of action must be based only on pecuniary factors . . . .”). Although the final rule does not explicitly reference ESG investing, the DOL explained that its purpose in adopting the rule was “to set forth a regulatory structure to assist ERISA fiduciaries in navigating these ESG investment trends.” Id. at 72,848. Although the SEC has not engaged in rulemaking to date, members of the Commission have expressed concerns that asset managers’ current disclosure practices with respect to ESG products are insufficient.14See, e.g., Elad L. Roisman, SEC Commissioner Advocates ESG Disclosure for Asset Managers, Not Issuers, CLS Blue Sky Blog (July 10, 2020), https://clsbluesky.law.columbia.edu/2020/07/10/sec-commissioners-advociates-esg-disclosure-for-asset-managers-not-issuers [perma.cc/RZ6B-KCKR] (“[R]etail investors who want ‘green’ or ‘sustainable’ products deserve more clarity and information about the choices they have.”).

Other interventions are on the horizon as well. Asset managers’ reliance on third parties, including index providers and rating agencies, in evaluating the ESG characteristics of portfolio companies has led some to call for greater regulation of those providers.15See, e.g., Dana Brakman Reiser & Anne Tucker, Buyer Beware: Variation and Opacity in ESG and ESG Index Funds, 41 Cardozo L. Rev. 1921, 2003 (2020) (“The topic of index regulation looms large on the U.S. regulatory horizon . . . . ”). As SEC commissioner Elad Roisman asked the SEC’s Asset Management Advisory Committee: “[T]o the extent that you are considering recommending that the SEC incorporate certain third parties’ disclosure guidelines into our rule set, have you thought about how the SEC should oversee those third parties? Also, should we extend our oversight further, for example, to ESG-index providers and ESG-rating agencies, since so many ‘ESG’ funds and investment products are derivative of their work?” Elad L. Roisman, Comm’r, SEC, Statement at the Meeting of the Asset Management Advisory Committee (Dec. 1, 2020), https://www.sec.gov/news/public-statement/roisman-statement-amac-meeting-120120 [perma.cc/D3SW-HFEW]. The Biden administration is taking steps to review and potentially replace the DOL rule,16Tim Quinson, Biden Administration Considers Reversing Trump’s ESG Rule Change, Bloomberg Green (Jan. 20, 2021, 6:21 PM), https://www.bloomberg.com/news/articles/2021-01-20/biden-administration-considers-reversing-trump-s-esg-rule-change [perma.cc/J9AP-P58A] (“The so-called ESG rule, or ‘Financial Factors in Selecting Plan Investments,’ was the only Department of Labor rule listed for review by President Joe Biden’s transition team.”). and new leadership at the SEC will likely look to expand corporate disclosures to address ESG issues.17Aaron Nicodemus, Biden’s SEC Set to Require Disclosure of ESG, Climate Change Risk, Compliance Week (Dec. 3, 2020, 4:12 PM), https://www.complianceweek.com/regulatory-policy/bidens-sec-set-to-require-disclosure-of-esg-climate-change-risk/29788.article [perma.cc/D3RU-4F5B] (predicting a Biden administration SEC “could require companies to disclose risks related to environmental, social and governance (ESG) issues, which includes addressing risks associated with climate change”).

These changes are taking place amid a rapidly evolving ESG landscape that has outpaced the academic literature. Instead, regulators are acting based on a variety of assumptions about how ESG funds operate,18See, e.g., Financial Factors in Selecting Plan Investments, 85 Fed. Reg. at 72,848 (“ESG funds often come with higher fees, because additional investigation and monitoring are necessary to assess an investment from an ESG perspective.”). often drawn from small-sample studies or anecdotal reports.19For example, in the proposed DOL rule on ESG funds in retirement plans, the footnote supporting the claim that “ESG funds often come with higher fees” cites to a June 2018 news report about the cost of ESG data (not funds). Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 39,113, 39,115 n.15 (proposed June 30, 2020) (to be codified at 29 C.F.R. pt. 2550); see also Toby Belsom et al., Principles for Responsible Inv., How Can a Passive Investor Be a Responsible Investor? (2019), https://www.unpri.org/download?ac=6729 [perma.cc/EFK3-NPGH]. The DOL also cites a white paper from a conservative think tank that analyzes only thirty ESG funds. See Wayne Winegarden, Pac. Rsch. Inst., Environmental, Social, and Governance (ESG) Investing: An Evaluation of the Evidence (2019), http://www.pacificresearch.org/wp-content/uploads/2019/05/ESG_Funds_F_web.pdf [perma.cc /88NZ-TT56]. For the countervailing claim that “asset-weighted expense ratio for ESG funds has decreased,” the DOL cites only a news report. Id. (citing Elisabeth Kashner, ETF Fee War Hits ESG and Active Management, FactSet (Jan. 22, 2020), https://insight.factset.com/etf-fee-war-hits-esg-and-active-management [perma.cc/KH8Y-ZCUJ]). By contrast, we present direct evidence of the fees associated with more than three hundred funds. Even as regulators move, we know relatively little about the market for ESG funds, the investment strategies these funds use, how the funds vote their proxies, and what the funds cost. At the same time, regulatory attention has focused on ESG funds as presenting concerns distinctive from other mutual funds. But it is unclear that ESG funds, as a category, present unique regulatory issues.20Although this Article’s empirical analysis focuses on U.S. investing, we note that the growing importance of ESG investment products raises regulatory concerns globally. See, e.g., Morgan Lewis, The Regulatory Overlay on ESG Investing (2020), https://www.morganlewis.com/-/media/files/publication/morgan-lewis-title/white-paper/2020/the-regulatory-overlay-on-esg-investing.pdf [perma.cc/QH5Z-AENF] (exploring regulatory considerations in the United States, the United Kingdom, the European Union, and Asia). These are all relevant policy questions that should inform rulemaking.

This Article offers the most complete empirical overview of ESG mutual funds to date. Using market-wide data on fund portfolios, voting, fees, and performance, we specifically target the concerns articulated by the SEC and the DOL. We combine detailed information on mutual funds with four proprietary datasets evaluating company-level ESG performance. Using this unique and comprehensive dataset, we explore the practical differences between ESG and non-ESG funds as well as the differences among ESG funds along four dimensions—portfolio composition, voting behavior, costs, and performance. The first two specifically target the SEC’s concerns, while the latter two relate to those raised by the DOL. Our goal is to provide an overview of the market as it currently stands for the purpose of informing a regulatory push that has the potential to reshape the ESG landscape.

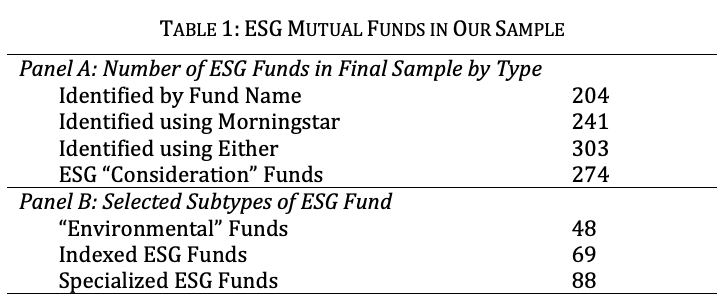

From the SEC’s perspective, the fundamental regulatory question is what investors are getting for their “ESG dollars.” We first confront the question of what ESG funds promise—the information conveyed both by the ESG label and fund disclosure practices. We then ask whether and how these funds deliver on that promise. To answer these questions, we survey the existing market and construct several categories of ESG mutual funds—funds with names that convey an ESG-oriented strategy, funds classified by Morningstar as ESG funds, and funds that purport to consider ESG factors in their investment criteria. We then analyze the portfolio composition and voting behavior of these funds to compare them across multiple dimensions. From the DOL’s perspective, the primary concerns are pecuniary: What, if anything are investors giving up when they invest in ESG funds? These pecuniary costs can be direct (in the form of fees) or indirect (in the form of lower raw or risk-adjusted returns). We engage with the concerns of both regulators by providing evidence about what investors are getting and what they are giving up to get it.

Descriptively, we uncover an evolving landscape of ESG funds. Today’s ESG funds range from single-issue funds that address water conservation or religious values to those that incorporate screening criteria into the construction of a broad-based index. We identify extensive disclosures of fund investment strategies—strategies that differ substantially—as well as the extent to which the fund incorporates ESG considerations into voting and engagement. We find, in short, a market that recognizes that ESG means different things to different investors.

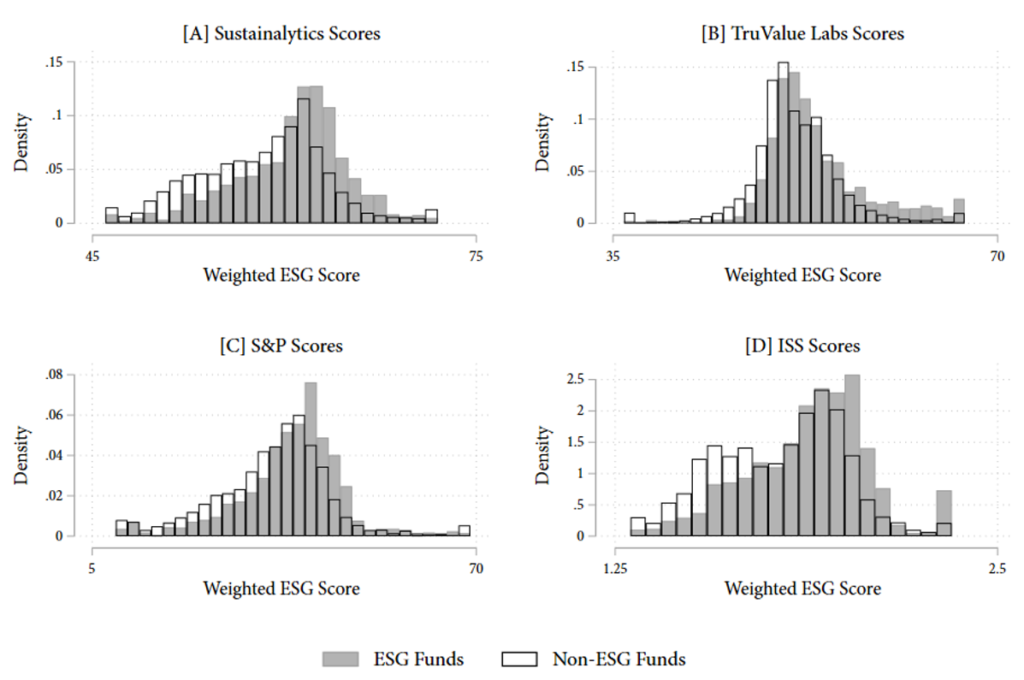

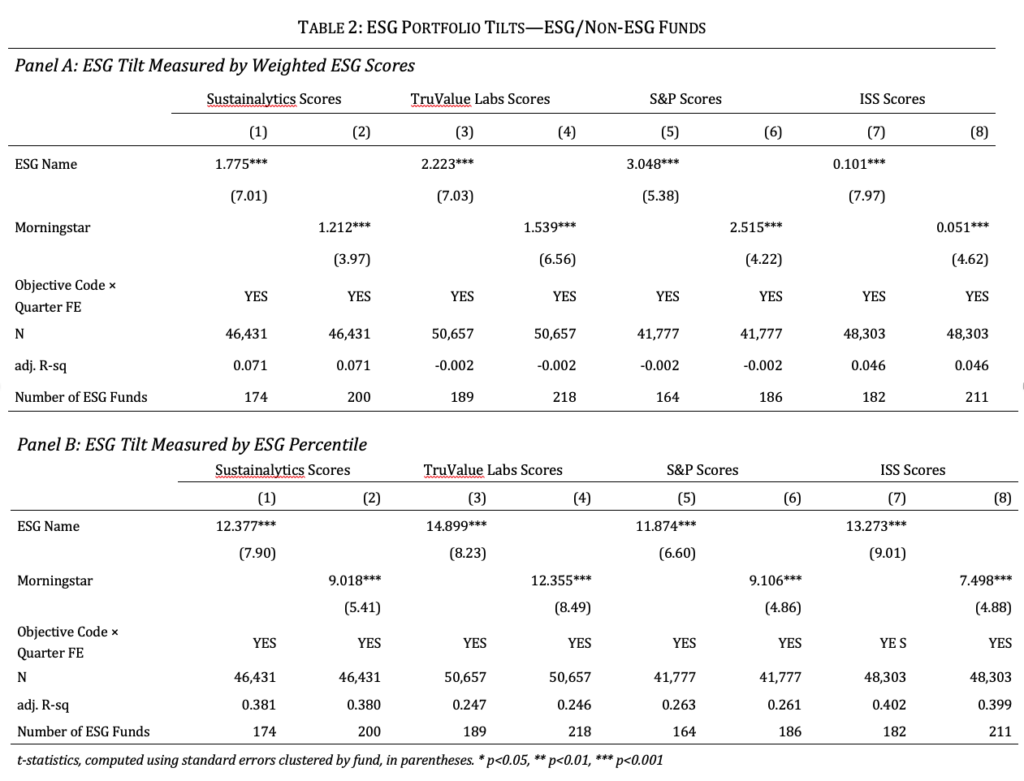

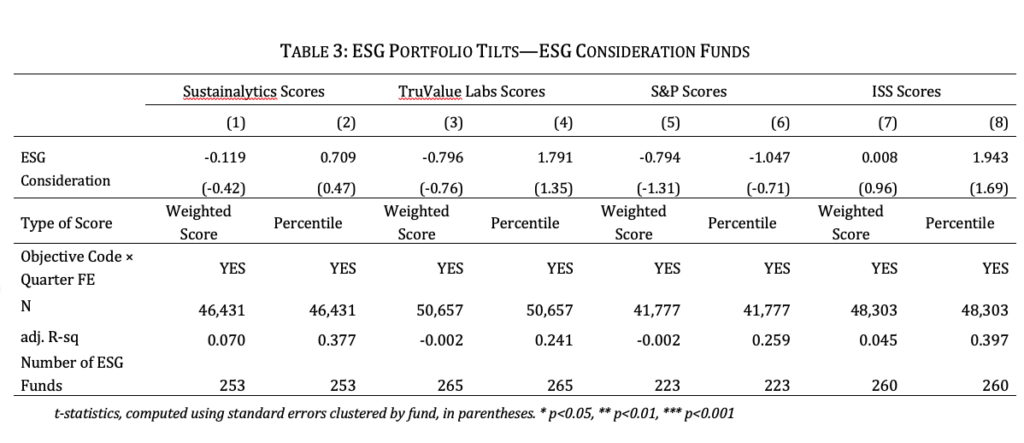

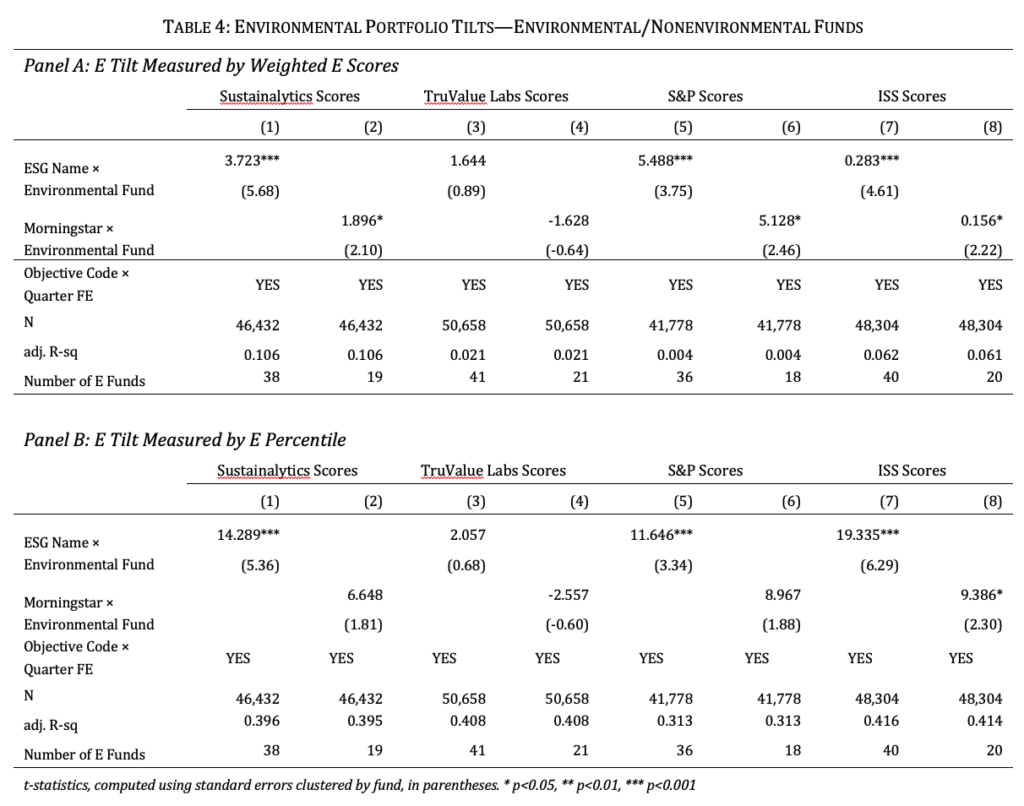

Empirically, we demonstrate that ESG funds behave differently from other funds. We first evaluate portfolio composition. Using data from four separate rating providers, we calculate what we term a fund’s “ESG tilt”—the asset-weighted average of the ESG scores of the fund’s portfolio companies. Funds that identify themselves as ESG funds hold portfolios that represent a significant ESG tilt. In other words, contrary to the SEC’s concern about “greenwashing,” ESG funds deliver on their promise to invest differently from other funds, and their holdings are rated more highly with respect to ESG. Because we incorporate ratings from four different providers, our findings offer reassurance that funds are not “gaming” a specific ESG index.

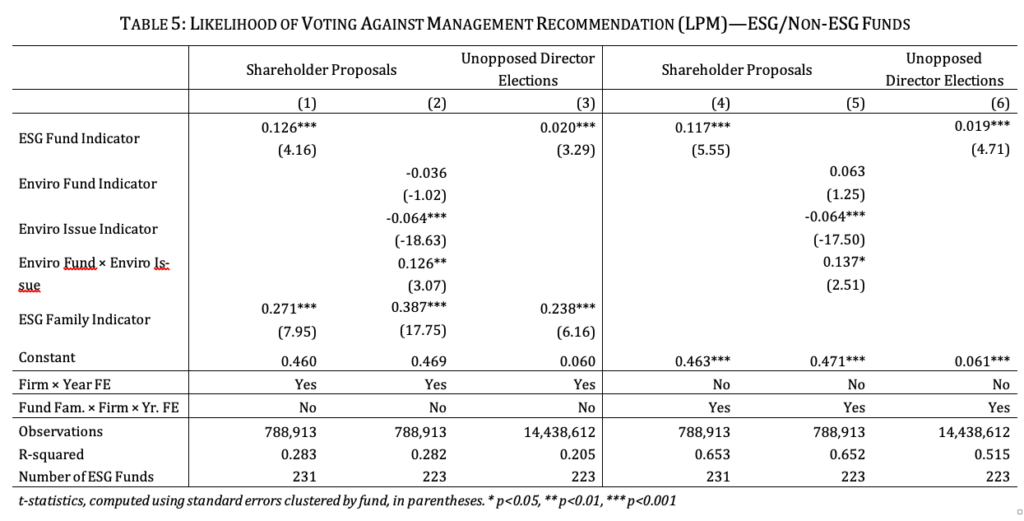

Second, we examine fund voting behavior. Although ESG mutual funds have been criticized for not casting their portfolio-company votes in accordance with their investment profiles,21See, e.g., James McRitchie, Mutual Fund Wars over Fees AND Proxy Votes, CorpGov.net (Sept. 3, 2019), https://www.corpgov.net/2019/09/mutual-fund-wars-over-fees-and-proxy-votes [perma.cc/L3EL-K5PN] (“Morningstar also found ESG funds from BlackRock, Vanguard, Fidelity Investments, TIAA-CREF and others cast a number of votes that appear to conflict with an ESG mandate, especially for funds specifically aimed at the environment.”). we document clear differences between the voting behavior of ESG and non-ESG funds. ESG funds do not automatically support every shareholder proposal related to ESG,22We note the absence of any clear benchmark as to the specific percentage of ESG proposals that a fund should support given obvious differences in proposal quality as well as firm-specific variation in the degree to which the actions contemplated by a given shareholder proposal are necessary or appropriate. but they do vote more independently of management compared to other funds when it comes to environmental and social issues. With respect to certain governance issues, such as say on pay, we also find clear differences. In short, ESG funds appear to be considering ESG criteria in voting as well as investment decisions.

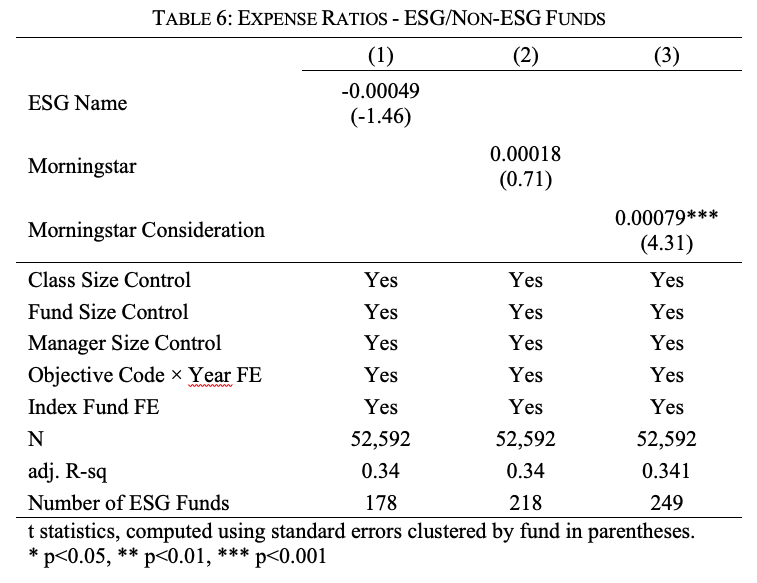

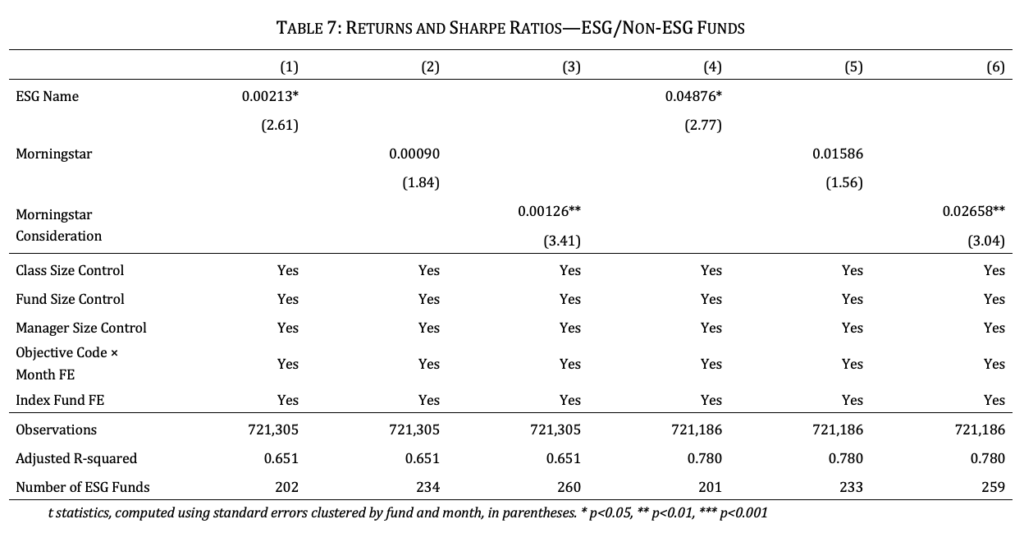

Third, we look at what these differences cost investors. To do so, we investigate the expenses associated with ESG funds and the returns offered by these funds. Contrary to the concern articulated by the DOL, we find no evidence that ESG funds cost more than comparable non-ESG funds or that they offer inferior performance during our sample period (either raw or risk adjusted). The results persist despite the inclusion of a battery of control variables intended to ensure that we are making “apples-to-apples” comparisons. While these tests are not intended to establish—nor can they establish—whether ESG funds are a “good” investment, we find no evidence that they perform worse than comparable funds.

A final empirical contribution of this paper is to address the impact of variation in ESG ratings. There is little consensus on what falls within the definition of ESG or how to weigh various ESG considerations.23Elad L. Roisman, Comm’r, SEC, Keynote Speech at the Society for Corporate Governance National Conference (July 7, 2020), https://www.sec.gov/news/speech/roisman-keynote-society-corporate-governance-national-conference-2020 [perma.cc/GK72-2XF7]. There are over six hundred ESG rating providers, and these providers rely on a range of different data sources and employ a variety of methodologies to analyze that data.24Nicolas Rabener, ESG Data: Dazed and Confused, ETF Stream (Nov. 30, 2020), https://www.etfstream.com/features/esg-data-dazed-and-confused [perma.cc/SKB3-HNYJ]; Jasmin Malik Chua, The Rise in ESG Ratings: What’s The Score?, Vogue Bus. (Oct. 28, 2020), https://www.voguebusiness.com/sustainability/the-rise-in-esg-ratings-whats-the-score [perma.cc/BLF5-BFFB] (explaining variation in methodologies used by ESG rating organizations). Commentators have highlighted the fact that these differences frequently lead to different ratings.25See, e.g., Jacqueline Poh, Conflicting ESG Ratings Are Confusing Sustainable Investors, Bloomberg (Dec. 11, 2019, 4:00 AM), https://www.bloomberg.com/news/articles/2019-12-11/conflicting-esg-ratings-are-confusing-sustainable-investors [perma.cc/54G3-8GUL] (“There are many ways to score a company on environmental, social, and governance criteria, making the results difficult to compare.”); see also infra notes 38–41 and accompanying text. Thus, for example, among automobile manufacturers, Tesla receives a top ESG rating from MSCI and a bottom rating from FTSE Russell.26James Mackintosh, Is Tesla or Exxon More Sustainable? It Depends Whom You Ask, Wall. St. J. (Sept. 17, 2018, 11:58 AM), https://www.wsj.com/articles/is-tesla-or-exxon-more-sustainable-it-depends-whom-you-ask-1537199931 [perma.cc/646H-Q8PB]. Although we do not directly interrogate differences among providers in this paper, we take the unique approach of incorporating ESG rating data from four different and well-known providers—ISS, S&P, Sustainalytics, and TruValue Labs—to measure the ESG orientation of the mutual fund portfolios that we examine. We find that although the providers take very different approaches to measuring ESG, the patterns are remarkably stable across providers.

In sum, we provide new data on the role of ESG in mutual fund investing and its effects. Our goal in this Article is modest. We do not seek to establish that ESG funds are good with respect to any specific benchmark—that they are effective in achieving particular environmental, social, or governance objectives or that they outperform non-ESG funds. Rather, the goal of this Article is to address concerns that ESG funds present distinctive regulatory concerns relative to the mutual fund market as a whole, either because (as the SEC fears) they are not doing what they purport to do or because (as the DOL fears) their economic performance is inferior to non-ESG funds. Either concern, if established, would warrant singling out ESG funds for distinctive regulatory treatment. Our empirical results, however, provide powerful evidence that ESG funds are offering investors something different from traditional funds with respect to both portfolio composition and voting, and that they are doing so without causing investors systematically to sacrifice economic performance.

Our findings describe the current state of the market for ESG funds. We do not purport to evaluate the claims made by ESG funds in the past. It may be that the recent proliferation of ESG products has generated meaningful market discipline. Nonetheless, our findings do not suggest a need for regulatory intervention either to limit investor access to ESG products or to curtail their use by ERISA fiduciaries.

I. The Rise of ESG Mutual Funds

A. The Background of ESG

Interest in ESG stems from increasing public, issuer, and investor attention to the impact of corporate operations on stakeholders and society more broadly. A range of commentators have criticized corporations for prioritizing shareholders at the expense of employees and customers.27See, e.g., Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans,’ Bus. Roundtable (Aug. 19, 2019), https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans [perma.cc/NX9G-GP2K]; The British Academy Proposes Principles for the Age of Purposeful Business, British Acad. (Nov. 27, 2019), https://www.thebritishacademy.ac.uk/news/british-academy-proposes-principles-age-purposeful-business [perma.cc/3LK2-WUEQ]; Klaus Schwab, Davos Manifesto 2020: The Universal Purpose of a Company in the Fourth Industrial Revolution, World Econ. F. (Dec. 2, 2019), https://www.weforum.org/agenda/2019/12/davos-manifesto-2020-the-universal-purpose-of-a-company-in-the-fourth-industrial-revolution [perma.cc/BD5A-UZ26]. The need to address climate change and other environmental issues has taken on heightened urgency and led to a focus on the role that corporations play in carbon emissions and other environmentally damaging activities.28Irene Banos Ruiz, The Role of the Business Sector in Tackling the Climate Crisis, DW (June 20, 2019), https://www.dw.com/en/the-role-of-the-business-sector-in-tackling-the-climate-crisis/a-49244192 [perma.cc/7L7T-M94Y]. Corporations have also faced scrutiny over their role in perpetuating racial and gender discrimination, wealth and wage inequality, and exploitation of disadvantaged groups.29See, e.g., Melissa Repko et al., Hashtags Won’t Cut It. Corporate America Faces a Higher Bar in a Reckoning on Racial Inequality, CNBC (June 12, 2020, 5:20 PM), https://www.cnbc.com/2020/06/12/action-wanted-corporate-america-faces-a-higher-bar-on-racial-inequality.html [perma.cc/RT2E-3FKW] (describing pressure faced by corporations to address racial inequality and economic justice).

The ESG movement generally calls for corporations to incorporate these concerns into their business practices. ESG is a rough label for an amalgamation of voices, interest groups, and substantive concerns. Those advocating greater attention to ESG often disagree on the relative importance of the various issues that they identify.30See, e.g., Thomas Brigandi, Paul Kovarsky & Paul McCaffrey, The Seven Asset Owner Approaches to ESG, Enterprising Inv. (Sept. 5, 2019), https://blogs.cfainstitute.org/investor/2019/09/05/the-seven-asset-owner-approaches-to-esg [perma.cc/S5X2-64H7] (describing seven different approaches by asset owners to ESG investing). The appropriate benchmark for corporate behavior ranges from demand that corporations at least consider a broader range of stakeholder and societal interests to an exhortation for corporations to “do no harm.”31See, e.g., Mike Phillips, How to Tell Your Impact from Your Sustainable Investing—and Avoid Greenwashing, Bisnow (July 5, 2020), https://www.bisnow.com/london/news/sustainability/how-to-tell-your-impact-from-your-sustainable-investing-and-avoid-greenwashing-105069 [perma.cc/DXX3-GDCQ] (“For the EU, sustainable investment must contribute to environmental objectives in a measurable way or contribute to social objectives, must do no significant harm to any social or environmental objectives, and must follow good governance practices.”).

The role of ESG in investing continues to evolve. For some years, investing on the basis of ESG considerations was thought to be a preference predicated on ethical, political, religious, or other objectives rather than an investment strategy grounded in financial risk and return.32See, e.g., Jess Liu, ESG Investing Comes of Age, Morningstar (Mar. 2021), https://www.morningstar.com/features/esg-investing-history [perma.cc/75FS-TYT3] (“What we now refer to as sustainable investing began with religious groups such as Muslims, Quakers, and Methodists who set ethical parameters on their investment portfolios.”). Commentators debated whether corporations could do well by doing good, and the data generated in response to this debate was mixed.33See, e.g., Robert G. Eccles, Ioannis Ioannou & George Serafeim, The Impact of Corporate Sustainability on Organizational Processes and Performance, 60 Mgmt. Sci. 2385 (2014) (reporting that high sustainability companies outperformed their counterparts in both stock returns and accounting performance); Pieter Jan Trinks & Bert Scholtens, The Opportunity Cost of Negative Screening in Socially Responsible Investing, 140 J. Bus. Ethics 193 (2017) (finding that negative screens were frequently correlated with inferior economic performance); Morgan Stanley, Inst. for Sustainable Investing, Sustainable Reality: Analyzing Risk and Returns of Sustainable Funds (2019), https://www.morganstanley.com/pub/content/dam/msdotcom/ideas/sustainable-investing-offers-financial-performance-lowered-risk/Sustainable_Reality_Analyzing_Risk_and_Returns_of_Sustainable_Funds.pdf [perma.cc/T6SN-9CTP] (studying nearly 11,000 mutual funds and ETFs from 2004 to 2018 and finding “no financial trade-off in the returns of sustainable funds compared to traditional funds”). More recently, an increasing number of scholars and policymakers claim that sustainable or ESG investing is associated with better economic performance.34See, e.g., Reiser & Tucker, supra note 15, at 1934 (“[D]ata showing ESG investing need not sacrifice returns—and indeed may increase them—is beginning to mount.”); Alex Edmans, Grow the Pie: How Great Companies Deliver Both Purpose and Profit 3 (2020) (“By applying a radically different approach to business, enterprise can create both profit for investors and value for society.”). Max Schanzenbach and Robert Sitkoff observe that investors may have different reasons for ESG investing and differentiate between ESG investing for moral or ethical reasons (which they term “collateral benefits ESG”) and ESG investing for risk and return benefits (which they call “risk-return ESG”).35Schanzenbach & Sitkoff, supra note 1, at 389–90.

One challenge to analyzing the relationship between ESG and economic performance is the absence of a clear definition of ESG. In a 2020 speech, then-acting SEC chairman Elad Roisman explains that “there is not consensus on what, exactly, ‘ESG’ means.”36Roisman, supra note 23. Stavros Gadinis and Amelia Miazad note that ESG’s “wide scope” encompasses a range of issues, from environmental concerns and workplace relationships to “the use of sugar in packaged foods.”37Stavros Gadinis & Amelia Miazad, Corporate Law and Social Risk, 73 Vand. L. Rev. 1401, 1414–15 (2020). Both the range of potential issues and the scope of data analysis required to evaluate a corporation’s performance with respect to those issues have fueled the development of an array of private standard-setters that gather ESG data and transform that data into company-specific ratings or rankings.38Alan R. Elliott, 50 Best ESG Stocks with a Sustainable Focus and Superior Stock Ratings, Inv.’s Bus. Daily (June 10, 2021, 5:40 PM), https://www.investors.com/news/esg-investing-puts-sustainable-spin-2020-esg-funds-best-esg-stocks-show [perma.cc/T8QZ-DWLP]. Today there are more than six hundred ESG rating organizations and rankings worldwide, and the number continues to grow.39SustainAbility, Rate the Raters 2020: Investor Survey and Interview Results 6 (2020), https://www.sustainability.com/globalassets/sustainability.com/thinking/pdfs/sustainability-ratetheraters2020-report.pdf [perma.cc/XCY7-YZTB]. The sheer multitude of ratings organizations makes any attempt to rank companies “difficult, and more of an art in certain situations than a science.”40Elliott, supra note 38; see also Hester M. Peirce, Comm’r, SEC, Scarlet Letters: Remarks Before the American Enterprise Institute (June 18, 2019), https://www.sec.gov/news/speech/speech-peirce-061819 [perma.cc/4E7M-EKGV] (“Not only is it difficult to define what should be included in ESG, but, once you do, it is difficult to figure out how to measure success or failure.”).

Moreover, because organizations vary both in the data that they collect and the methodology that they use to incorporate that data, ESG ratings vary substantially among providers. Some providers rely on questionnaires to collect information from issuers, some review issuers’ public disclosures and filings, and some rely on third-party sources.41See generally Donnelley Fin. Sols., The Future of ESG and Sustainability Reporting 7–9 (2018), https://www.dfinsolutions.com/sites/default/files/documents/2019-01/dfin_thought_leadership_whitepaper_ESG_Sustainability_Reporting_0.pdf [perma.cc/5EQQ-JKRW] (summarizing data used by several major ESG ratings providers). Commentators have documented substantial variation among ratings and have, as a result, questioned the viability of evaluating an issuer’s ESG accurately.42See, e.g., Florian Berg, Julian F. Koelbel & Roberto Rigobon, Aggregate Confusion: The Divergence of ESG Ratings, SSRN (Dec. 29, 2020), https://doi.org/10.2139/ssrn.3438533 [perma.cc/N6BW-LABB] (comparing ratings from six prominent agencies and reporting substantial differences); Feifei Li & Ari Polychronopoulos, Rsch. Affiliates, What a Difference an ESG Ratings Provider Makes! (2020), https://www.researchaffiliates.com/content/dam/ra/documents/770-what-a-difference-an-esg-ratings-provider-makes.pdf [perma.cc/HBH3-7ZNU]; Jim Hawley, TruValue Labs, ESG Ratings and Rankings (2017), https://truvaluelabs.com/wp-content/uploads/2017/12/ESG-Ratings-and-Rankings-All-Over-the-Map.pdf [perma.cc/EUS9-64Y7]. SEC commissioner Hester Peirce notes that “the different ratings available can vary so widely[] and provide such bizarre results that it is difficult to see how they can effectively guide investment decisions.”43Peirce, supra note 40.

B. The Growth of ESG Mutual Funds

The challenges associated with defining and measuring ESG have not impeded its growth as an investment strategy. The use by mutual funds of ESG criteria in selecting investments and engaging with portfolio companies is one of the hottest investment trends. Investments in the United States in funds using ESG data have almost doubled over the last four years, from $22.9 trillion in 2016 to over $40 trillion in 2020.44Anne-Laure Foubert, ESG Data Integration by Asset Managers: Targeting Alpha, Fiduciary Duty & Portfolio Risk Analysis, Opimas (June 17, 2020), http://www.opimas.com/research/570/detail [perma.cc/7MTU-KSYL]. Net flows of assets into ESG funds “in 2020 were more than double the total for 2019 and nearly 10 times more than in 2018.”45Jon Hale, A Broken Record: Flows for U.S. Sustainable Funds Again Reach New Heights, Morningstar (Jan. 28, 2021), https://www.morningstar.com/articles/1019195/a-broken-record-flows-for-us-sustainable-funds-again-reach-new-heights [perma.cc/2M4B-EYQL]. Many retail investors express strong preferences for ESG investing, and the mutual fund market is driven largely by those preferences.46MSCI, Swipe to Invest: The Story Behind Millennials and ESG Investing (2020), https://www.msci.com/documents/10199/07e7a7d3-59c3-4d0b-b0b5-029e8fd3974b [perma.cc/5KFL-ZAJP].

ESG investing can incorporate several different strategies. One is investment screening, in which a fund uses ESG data as a component of its investment decisions. Funds may engage in negative or exclusionary screening, in which they exclude certain types of companies—oil, tobacco, and gambling companies are common examples—from their portfolio. Alternatively, funds can engage in positive screening, which involves limiting their portfolios to investments that meet designated ESG criteria. Funds can also incorporate ESG data as part of a more comprehensive analysis of an investment, what some funds term an “integrated” use of ESG criteria. For example, Vanguard’s Global ESG Select Stock Fund describes its ESG strategy as “[r]egularly including ESG factors alongside the traditional investment analysis performed by active fund managers. This strategy doesn’t require the fund to rule out any company, industry, or country simply because it’s involved in a business activity that may be objectionable to some.”47ESG Investing: Discover Funds That Reflect What Matters Most to You, Vanguard (July 31, 2020), https://investor.vanguard.com/investing/esg [perma.cc/6UKH-A4C2].

ESG investing’s potential impact on mutual fund investors increases because of the ease of incorporating ESG screening into a passive investment strategy. The amount of money invested through passive or indexed strategies has grown dramatically, fueled both by the low costs of indexing and by studies suggesting that active strategies do not consistently outperform indexed strategies over time.48See, e.g., Jill E. Fisch, Asaf Hamdani & Steven Davidoff Solomon, The New Titans of Wall Street: A Theoretical Framework for Passive Investors, 168 U. Pa. L. Rev. 17, 19 (2019) (explaining growth of market for index funds). The extensive number of ESG rating organizations creates a ready tool for an index-based investment product in which the selection of a mutual fund’s portfolio companies is predicated on a rating conferred by an external provider. For example, four of Vanguard’s five current ESG fund offerings are indexed, with their portfolio composition tracking several indices created by FTSE Russell.49ESG Investing, supra note 47; see also FTSE4 Good Index Series, FTSE Russell, https://www.ftserussell.com/products/indices/ftse4good [perma.cc/787D-WM2S]. Indexed mutual funds and exchange-traded funds (ETFs) enable funds to offer the cost advantages and scalability associated with a passive investment strategy, while enabling fund sponsors to delegate the evaluation of portfolio companies to an index provider.50See Adriana Z. Robertson, Passive in Name Only: Delegated Management and “Index” Investing, 36 Yale J. Regul. 795 (2019) (explaining that index funds delegate stock selection decisions to those who construct the index, who therefore retain a substantial amount of investment discretion).

A second ESG investment strategy is engagement.51Michelle Edkins at BlackRock defines engagement as “direct communication between investors and companies[] on environmental, social and governance matters.” BlackRock & Ceres, 21st Century Engagement 4 (2015), https://www.ceres.org/sites/default/files/reports/2017-03/21st%20Century%20Engagement%20-%20Investor%20Strategies.pdf [perma.cc/L7KU-TW3W]. ESG engagement involves a fund exercising its power as a shareholder in an effort to cause its portfolio companies to perform better on some ESG criteria. Engagement may be limited to how the fund votes the shares of its portfolio companies but can also include more proactive measures such as writing letters, meeting with management, sponsoring shareholder proposals, and initiating litigation.52See, e.g., Impact Investing, Boston Tr. Walden, https://www.bostontrustwalden.com/investment-services/impact-investing [perma.cc/6EE7-BGCA] (describing its engagement strategy).

A third strategy is impact investing, which targets companies seeking to achieve specific goals that are beneficial to society. Impact investing might direct an investment to a company that produces a clean energy product, such as wind or solar power, or alternatively might finance efforts to convert the manufacturing processes of a traditional company to reduce its environmental impact.53See, e.g., Martin, supra note 3 (“Many sustainable fund managers—including our own—reserve a portion of the portfolio for actively intervening in companies that need an extra nudge, using the voting rights that share ownership affords them to try to change the companies from within.”).

Notably, the foregoing ESG strategies can be used independently or in combination. For example, although an S&P 500 index fund54See Adriana Z. Robertson, The (Mis)uses of the S&P 500, SSRN (Dec. 5, 2020), https://doi.org/10.2139/ssrn.3205235 [perma.cc/NY4H-98FY] (describing the extensive use of the S&P 500 index by mutual funds). does not incorporate ESG considerations into its stock selection process, nothing prevents that fund from engaging on ESG issues. By the same token, a fund that invests according to ESG criteria need not engage on ESG issues. Indeed, media reports have highlighted instances in which ESG funds have not voted differently, even with respect to ESG issues, from non-ESG funds.55See, e.g., Gita R. Rao, Opinion, A Surprise About Some ESG Funds—They Actually Vote Against Environmental and Socially Conscious Resolutions, MarketWatch (Dec. 18, 2020, 10:40 AM) https://www.marketwatch.com/story/a-surprise-about-some-esg-funds-they-actually-vote-against-environmental-and-socially-conscious-resolutions-11608306020 [perma.cc/XP9X-MU2W] (“[S]ome index funds with an environmental, social and corporate governance mandate rarely vote in favor of their stated preferences.”).

How funds communicate the role that ESG plays in their investment strategy is a separate issue. One obvious tool for communicating a fund’s strategy is its name. We constructed our initial sample of ESG funds, for example, by searching for terms such as “sustainable,” “ESG,” and “green” in fund names. Using a fund’s name to communicate the role of ESG is tricky, however.

Consider a fund called “XYZ Green Fund.” What information is conveyed by the fund’s name? One possibility is that the fund invests in sustainable or green industries, such as solar panel and wind turbine manufacturers or makers of electric vehicles. An alternative is that the fund seeks out companies that have environmentally responsible practices relative to their industry peers, motivated by a desire to encourage more environmentally responsible practices or by the expectation that such companies will be better positioned to withstand market and regulatory burdens that may be imposed on environmentally harmful companies in the future. The delivery service UPS runs a large fleet of diesel trucks, hardly a “green” business compared to wind farms. If UPS has converted more of its vehicles to electric than competitors, however, then the XYZ Green Fund might buy more of UPS and less of FedEx. Many of the companies in this fund’s portfolio may not be “green” in the sense used above, but they may be better situated than their competitors to thrive if carbon emissions are restricted.

There is a third possibility too. Perhaps XYZ Green Fund is an impact fund that seeks to make companies greener (either to generate returns or to make the world a better place). That XYZ Green Fund might hold a portfolio of particularly egregious polluters—industrial dinosaurs that have failed to consider their environmental impact at all—and then, through the power of their proxy voting, attempt to induce those companies to improve. The portfolio of such a fund would look anything but green in either of the above senses, but such a strategy might nevertheless be consistent with the “green” name so long as the fund seeks to reform those companies.

Independent of a fund’s strategy for investing and engaging is the challenge of determining what counts as an environmentally responsible company. Is Tesla a green company because it makes electric vehicles, or is it not, because it harvests vast quantities of lithium for its batteries? A wind farm company might be green because it produces electricity with zero emissions, but what if it repeatedly refuses to take straightforward steps to mitigate the impact of its wind farms on wildlife?56As Commissioner Peirce recently put it, “One person’s ecofriendly windmill is another person’s bird killer.” Hester Peirce, Remarks by Commissioner Peirce on the Role of Asset Management in ESG Investing, Harv. L. Sch. F. on Corp. Governance (Sept. 18, 2020), https://corpgov.law.harvard.edu/2020/09/18/remarks-by-commissioner-peirce-on-the-role-of-asset-management-in-esg-investing [perma.cc/YXW7-TJ2E].

What is true of the “E” in ESG is equally true of “S” and “G.” A company might be a leader in addressing workplace inequality but fail to oversee child labor practices in its supply chain. Funds that purport to consider E, S, and G must also consider how to weigh practices across all three categories. Does Facebook’s low carbon footprint outweigh its failures in safeguarding customer privacy or its dual-class voting structure? Of course, this problem is not unique to ESG investing; there are a plethora of different self-described “growth” and “value” funds in the market, and different funds sometimes have very different conceptions of what “growth” and “value” investing strategies mean.57Robertson, supra note 50, at 825–26 (describing the heterogeneity across different “growth” and “value” indices tracked by index funds). Notwithstanding this, no one reasonably argues that funds should not be able to use the words “growth” or “value” in their names.

Obviously, a fund’s name cannot fully explain its investing strategy. Mutual fund companies are required to provide information beyond fund names, however. They must share information that enables investors to determine if the fund’s conception of ESG matches the investor’s preferences. The SEC’s disclosure requirements for mutual funds take a layered approach.58Joseph A. Franco, A Consumer Protection Approach to Mutual Fund Disclosure and the Limits of Simplification, 15 Stan. J.L. Bus. & Fin. 1 (2009) (describing the SEC’s mutual fund disclosure requirements). Mutual funds disclose a minimum amount of information in the summary prospectus, which is typically three to four pages in length.59See Enhanced Disclosure and New Prospectus Delivery Option for Registered Open-End Management Investment Companies, 74 Fed. Reg. 4546, 4549 (Jan. 26, 2009) (stating that the summary prospectus contains “key information that is important to an informed investment decision”). Additional information is provided in the statutory prospectus and the statement of additional information.60Jill E. Fisch, Rethinking the Regulation of Securities Intermediaries, 158 U. Pa. L. Rev. 1961, 1969–70 (2010) (describing SEC-mandated mutual fund disclosures). In these documents, funds disclose their investment objectives and how they incorporate ESG criteria. They also disclose whether they follow an index strategy and, if so, the applicable index. In many cases, they also disclose their policies regarding voting or engagement. Furthermore, mutual funds are required to disclose their portfolio holdings on a quarterly basis.61Id. at 1970. Finally, SEC rules adopted in 2003 require mutual funds to disclose their overall voting policies as well as the votes they cast at each of their portfolio companies.62Disclosure of Proxy Voting Policies and Proxy Voting Records by Registered Management Investment Companies, 68 Fed. Reg. 6564 (Feb. 7, 2003). This information is publicly available on EDGAR. See EDGAR Mutual Funds, SEC, https://www.sec.gov/edgar/searchedgar/mutualsearch.html.

Commentators have criticized the mutual fund disclosure system on the basis that retail investors rarely read the prospectus or other disclosure documents.63A 2006 Investment Company Institute survey reported that only 30 percent of recent mutual fund investors consulted shareholder reports before their most recent purchase and only 34 percent used the fund prospectus. Inv. Co. Inst., Understanding Investor Preferences for Mutual Fund Information 12 (2006), https://www.ici.org/system/files/attachments/pdf/rpt_06_inv_prefs_full.pdf [perma.cc/3TZU-VWMC]. A 2008 telephone survey reported that nearly two-thirds of respondents who said that they received mutual fund prospectuses “rarely,” “very rarely,” or “never” read them. Abt SRBI, Mandatory Disclosure Documents Telephone Survey 56 (2008), https://www.sec.gov/pdf/disclosuredocs.pdf [perma.cc/9BFA-LWU7]. In recent years, however, internet-based disclosures have become increasingly detailed. In addition to providing links to the mandated disclosure documents, funds generally provide detailed descriptions of their screening and engagement strategies on their websites.64See, e.g., ESG Investing, supra note 47. Mutual fund companies are starting to post their voting disclosures on their websites as well. For example, Vanguard provides a tool that enables investors to search by fund for the proxy votes cast at each of the fund’s portfolio companies for the 2020–2021 proxy season.65How Our Funds Voted, Vanguard, https://about.vanguard.com/investment-stewardship/how-our-funds-voted [perma.cc/RP36-35CA].

C. Concerns over ESG Funds

The growth in number and size of ESG funds has led to several concerns. Perhaps the most serious concern is that ESG funds falsely portray themselves as adhering to an ESG investing (or voting) strategy to attract investor money, a practice characterized as “greenwashing.”66Rachel Evans, How Socially Responsible Investing Lost Its Soul, Bloomberg Businessweek (Dec. 18, 2018, 1:47 PM), https://www.bloomberg.com/news/articles/2018-12-18/exxon-great-marlboros-awesome-how-esg-investing-lost-its-way [perma.cc/UCY9-NX79]. Without consistent data for evaluating the sustainability of individual portfolio companies, it is difficult to measure the ESG orientation of a mutual fund or to compare the “greenness” of one fund’s portfolio with that of another. As one commentator observes, the possibility that investors do not understand what they are buying or are misled by false claims of sustainability raises consumer-protection concerns, pointing to a gap in existing law.67See Zachary Barker, Note, Socially Accountable Investing: Applying Gartenberg v. Merrill Lynch Asset Management’s Fiduciary Standard to Socially Responsible Investment Funds, 53 Colum. J.L. & Soc. Probs. 283, 286 (2020).

Greenwashing is not the only issue. Commentators express concern that ESG funds charge higher fees.68E.g., Aaron Brown, Opinion, Many ESG Funds Are Just Expensive S&P 500 Indexers, Bloomberg (May 7, 2021, 7:00 AM), https://www.bloomberg.com/opinion/articles/2021-05-07/many-esg-funds-are-just-expensive-s-p-500-indexers [perma.cc/3UDP-R66C]. These fees could reflect the higher costs associated with identifying and monitoring investments from an ESG perspective.69See Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 72,846, 72,880 (Nov. 13, 2020); see also Belsom et al., supra note 19, at 15 (noting that ESG passive investing strategies likely result in higher fees compared to standard passive funds); Winegarden, supra note 19, at 11–12 (finding average expense ratio of sixty-nine basis points for ESG funds compared to nine basis points for broad-based S&P 500 index funds). It could also be the case that ESG funds are smaller and therefore less able to benefit from economies of scale.70David Kathman, Are Sustainable Funds More Expensive?, Morningstar (Mar. 16, 2017), https://www.morningstar.com/articles/798280/are-sustainable-funds-more-expensive [perma.cc/6W9E-H676] (“Most ESG funds are not very large, so they are not able to benefit from the economies of scale found in funds with huge asset bases.”). More nefariously, funds could be capitalizing on the demand for ESG products and charging high fees while providing little incremental value to investors.

Another concern is that ESG funds sacrifice performance. Commissioner Roisman, for example, has worried about “the extent to which retail investors understand that some of these funds may be prioritizing environmental or social goals above the fund’s economic returns.”71Roisman, supra note 23 (emphasis omitted). Although early studies provided some evidence for this claim, more recent studies suggest that ESG strategies have evolved and that ESG funds have performed as well as or better than non-ESG funds in recent years.72Elizabeth Schulze, ‘Sustainable’ Investors Match the Performance of Regular Investors, New IMF Research Finds, CNBC (Oct. 10, 2019, 10:34 AM), https://www.cnbc.com/2019/10/10/imf-research-finds-esg-sustainable-investment-funds-dont-underperform.html [perma.cc/98MM-NBGW]; see Siobhan Riding, Majority of ESG Funds Outperform Wider Market Over 10 Years, Fin. Times (June 13, 2020), https://www.ft.com/content/733ee6ff-446e-4f8b-86b2-19ef42da3824 [perma.cc/CT2B-9LEB] (“[A] sample of 745 Europe-based sustainable funds shows that the majority of strategies have done better than non-ESG funds over one, three, five and 10 years.”).

A final concern is the variety of ESG funds and the investment strategies they offer. ESG funds may be actively managed or tied to an index. They may focus on a small number of companies or offer broad diversification. They may focus on stock selection or engage actively with their portfolio companies. And they may offer a range of substantive ESG priorities—environmental sustainability, diversity, or ethical and religious values—or take a more generalist approach to ESG. This variation may lead to investor confusion.73See, e.g., Jon Drimmer, Tara K. Giunta & Audrey Karman, ESG Strategies Could Be Misleading Investors, Lexology (Mar. 11, 2020), https://www.lexology.com/library/detail.aspx?g=46ec13e9-da35-47c2-8164-abc44bd991d3 [perma.cc/AST6-FYY7] (“[G]rowth in ESG investing has led to increased potential for confusion among the investing public as to what ESG means for a particular company, fund, or investor.”). Dana Reiser and Anne Tucker warn that the dizzying array of ESG mutual funds means that investors cannot readily “differentiate between their claims of ESG effort or impact.”74Reiser & Tucker, supra note 15, at 1997. Some commentators have called for increased disclosure mandates, such as an SEC requirement that mutual funds disclose how they “approach ESG and long-term matters generally, including voting and any engagement.”75Andy Green, Making Capital Markets Work for Workers, Investors, and the Public: ESG Disclosure and Corporate Long-Termism, 69 Case W. Rsrv. L. Rev. 909, 925 (2019). In a 2020 speech, then-acting SEC chair Allison Herren Lee has warned that greater regulation may be necessary, both to standardize disclosure by ESG fund managers and to “require advisers to maintain and implement policies and procedures governing their approach to ESG investment.”76Speech, Allison Herren Lee, Comm’r, SEC, Playing the Long Game: The Intersection of Climate Change Risk and Financial Regulation, Keynote Remarks at PLI’s 52nd Annual Institute on Securities Regulation (Nov. 5, 2020), https://www.sec.gov/news/speech/lee-playing-long-game-110520 [perma.cc/GH2W-6F5Z].

II. Regulatory Pressure on ESG Funds

The significant growth in ESG investing has begun to attract the attention of regulators. In 2020, both the SEC, which comprehensively regulates mutual funds, and the DOL, which regulates the trillions of dollars saved in employee retirement accounts,77Emp. Benefits Sec. Admin., What We Do, U.S. Dep’t of Lab., https://www.dol.gov/agencies/ebsa/about-ebsa/about-us/what-we-do [perma.cc/HXS7-ZJRC]. took action motivated by concerns about ESG investing. The SEC sought comments from the public on potential future regulation related to the use of ESG terms in fund names.78Request for Comments on Fund Names, 85 Fed. Reg. 13,221 (Mar. 6, 2020). In doing so, the SEC raised a number of important issues about what, exactly, ESG funds are selling.79In April 2021, the SEC Division of Examinations released a Risk Alert regarding ESG investing. Div. of Examinations, SEC, Risk Alert: The Division of Examinations’ Review of ESG Investing (2021), https://www.sec.gov/files/esg-risk-alert.pdf [perma.cc/U92M-5X4H]. The Alert warned of a variety of deficiencies in ESG investing including unsubstantiated claims regarding ESG approaches and proxy voting problems. Id. at 4–5. Although the Risk Alert is a statement by the Division’s staff, not a rulemaking, we note that it focuses on ESG investment strategies as presenting distinctive compliance risks for investment advisers and mutual funds. Meanwhile, the DOL adopted a rule creating potential legal risk for retirement plans that include ESG funds.80Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 72,846 (Nov. 13, 2020) (to be codified at 29 C.F.R. pt. 2509, 2550). The DOL rule was adopted over vigorous dissent from much of the asset management industry,81Brian Anderson, Analysis Finds 95% of Comments Oppose DOL’s ESG Rule, 401(k) Specialist (Aug. 21, 2020), https://401kspecialistmag.com/analysis-finds-95-of-comments-oppose-dols-esg-rule [perma.cc/MR88-427Q]. although as of early 2021, its future is uncertain.

A. The SEC Names Rule

The SEC has signaled interest in potentially tightening regulation of mutual fund names that suggest ESG investing.82Request for Comments on Fund Names, 85 Fed. Reg. at 13,221. This interest is motivated by concern about greenwashing—that a fund might incorporate labels such as “ESG,” “green,” or “sustainable” to give investors the false impression that the fund offers ESG exposure when it actually invests conventionally.83See Roisman, supra note 23 (“Another risk that concerns me is ‘greenwashing’—asset managers conveying a false impression to retail investors that a given product is environmentally friendly.”). In a speech, SEC commissioner Hester Peirce noted that “[i]nvestors are pouring assets into ESG-labelled investment products, and asset managers are churning out new products in response. While the demand for these products is clear, less clear is what exactly these investors are buying.”84Speech, Hester M. Peirce, Comm’r, SEC, Lucy’s Human: Remarks at Virtual Roundtable on the Role of Asset Management in ESG Investing Hosted by Harvard Law School and the Program on International Financial Systems (Sept. 17, 2020), https://www.sec.gov/news/speech/peirce-lucys-human-091720 [perma.cc/2XUE-PCZR]. In particular, Commissioner Peirce highlighted the risk of “an asset manager who talks the ESG talk, but doesn’t walk the ESG walk.”85Id. Given the rapidly increasing demand for ESG funds, should we be concerned that funds that hold themselves out as pursuing social or environmental goals through their names are not actually delivering on those marketing promises?

The SEC’s Names Rule, Rule 35d-1, was predicated on the fact that mutual fund names are an important source of information to investors.86See Investment Company Names, 66 Fed. Reg. 8509, 8510 (Feb. 1, 2001) (“[T]he name of an investment company may communicate a great deal to an investor.”). Under section 35(d) of the Investment Company Act, it is unlawful for a fund to use in its name “any word or words that the Commission finds are materially deceptive or misleading.”8715 U.S.C. § 80a-34(d). Originally, the SEC policed naming conventions through staff guidance and occasional one-off enforcement actions for particularly misleading funds.88E.g., Div. of Invest. Mgmt., SEC, No. 2013-12, IM Guidance Update: Fund Names Suggesting Protection from Loss (2013), https://www.sec.gov/divisions/investment/guidance/im-guidance-2013-12.pdf [perma.cc/GEY7-8Q2F]. In 1996, Congress amended the Investment Company Act of 1940 to give the SEC explicit rulemaking authority to enforce section 35(d).89National Securities Markets Improvement Act of 1996, Pub. L. No. 104-290, § 208, 110 Stat. 3416, 3432 (codified at 15 U.S.C. § 80a-34(d)). As a result, the SEC promulgated the Names Rule in 1997 and adopted it in 2001.9017 C.F.R. § 270.35d-1 (2020).

The Names Rule outlines requirements for the use of certain terms in mutual fund names. The most important requirement is for funds whose name suggests a particular type of investment or industry. Under the rule, a fund whose name contains a type of security, an industry, or a geographic area must hold 80% of its portfolio in investments consistent with the designation.91Id. § 270.35d-1(a). Thus, the “XYZ Pharmaceuticals Sector Fund” must hold 80% of its assets in pharmaceutical companies, and the “ABC Bond Fund” must hold 80% bonds.

This much is straightforward, but the Names Rule also excludes terms that describe a fund’s “investment objective, strategies, or policies” from the 80% requirement.92Request for Comments on Fund Names, 85 Fed. Reg. 13,221, 13,222 (Mar. 6, 2020). Thus, while a “stock fund” must hold 80% stock, there is no requirement under the Names Rule that a “growth fund” hold 80% of its portfolio in assets with any particular characteristic. For example, “growth” is an investment strategy that has many different connotations. To some, a growth stock is a stock of a company with a low ratio of book value to market value of equity.93This is the standard definition of “growth” in the asset pricing literature. See, e.g., Eugene F. Fama & Kenneth R. French, Common Risk Factors in the Returns on Stocks and Bonds, 33 J. Fin. Econ. 3, 41 (1993). To others, it connotes smaller companies with higher potential returns (often coupled with higher risk).94See, e.g., Growth Stock, NASDAQ, https://www.nasdaq.com/glossary/g/growth-stock [perma.cc/R8MC-AUDG]. Given this ambiguity, assessing what counts as a growth stock is far more difficult for a regulator than identifying “stock” in a portfolio. While names including terms like “growth” and “conservative” are subject to the antifraud provisions of the securities laws and can be “deceptive or misleading” within the meaning of section 35(d), the bright-line requirement of the Names Rule does not apply to these terms.

Despite the limitations imposed by the Names Rule, funds have substantial leeway in the names that they choose. Moreover, investors rely heavily on names in selecting mutual funds. Studies have shown that when mutual funds adopt a name that is associated with a hot investment trend or style, investments into the fund increase even if the name change does not reflect any change in the fund’s underlying strategy.95E.g., Michael J. Cooper, Huseyin Gulen & P. Raghavendra Rau, Changing Names with Style: Mutual Fund Name Changes and Their Effects on Fund Flows, 60 J. Fin. 2825 (2005) (finding substantial inflows into funds that change their names to look like hot styles); Susanne Espenlaub, Imtiaz ul Haq & Arif Khurshed, It’s All in the Name: Mutual Fund Name Changes After SEC Rule 35d-1, 84 J. Banking & Fin. 123, 133 (2017) (finding superficial name changes attract significantly positive abnormal flows); Sadok El Ghoul & Aymen Karoui, What’s in a (Green) Name? The Consequences of Greening Fund Names on Fund Flows, Turnover, and Performance, 39 Fin. Rsch. Letters, Mar. 2021, art. 101620 (finding funds that changed their name to a more ESG-related name had increased flows but no change in performance).

The SEC has not updated the Names Rule in twenty years. In 2020, however, the SEC issued a request for comment on the rule.96Request for Comments on Fund Names, 85 Fed. Reg. at 13,221. Requests for comment are often precursors to rulemaking. The request indicates that the SEC may be looking to revise the Names Rule in the near future. The SEC’s 2020 request for comment touched on a number of issues that the SEC staff felt might warrant updating, including the use of derivatives in funds to create leverage, the use of hybrid instruments that do not fit neatly into the categories of “stock” and “bond,” and the evolution of index funds. Among the issues upon which the SEC requested comment was the application of the Names Rule to ESG funds. The SEC specifically noted potential confusion about whether ESG is an investment type (to which the Names Rule would apply) or an investment strategy (to which it would not).97Id. at 13,223 (“The staff has observed that some funds appear to treat terms such as ‘ESG’ as an investment strategy . . . while others appear to treat ‘ESG’ as a type of investment . . . .”).

Lurking behind the naming issue is the genuinely unsettled reality of ESG investing. ESG is a rapidly evolving space with numerous strategies pursuing different goals in different ways, and investors may not understand the role of ESG in a particular fund’s strategy. For that reason, the SEC suggestively asked, “Instead of tying terms such as ‘ESG’ in a fund’s name to any particular investments or investment strategies, should we instead require funds using these terms to explain to investors what they mean by the use of these terms?”98Id. at 13,224. Commissioner Roisman signaled a similar concern in a 2020 speech:

[A]sset managers who want to use these terms to name their funds or advertise their products should be required to explain to investors what they mean. . . . [H]ow do the terms “ESG,” “green,” and “sustainable” relate to a fund’s objectives, constraints, strategies, and the characteristics of its holdings? Are “E,” “S,” and “G” weighted the same when selecting portfolio companies? Does the fund intend to subordinate the goal of achieving economic returns to non-pecuniary goals, and, if so, to what extent?101F99Roisman, supra note 23.

Requiring ESG funds to explain their ESG commitments to investors seems unobjectionable; even absent regulatory change, funds holding themselves out as ESG funds ought to be delivering something different to investors to justify their use of the ESG nomenclature. The portfolios of ESG funds should be distinguishable from non-ESG funds. Similarly, although the voting policies of ESG funds might differ among themselves, we would expect ESG funds collectively to vote differently from non-ESG funds, especially on salient ESG issues.

B. DOL Fiduciary Duties in Retirement Plans

Participant-directed retirement accounts, such as 401(k) plans, are among the largest holders of mutual funds.100Inv. Co. Inst., 2021 Investment Company Fact Book 197 fig.8.19 (2021), https://www.ici.org/system/files/2021-05/2021_factbook.pdf [perma.cc/2W6J-UGA6]. In a participant-directed plan, the employer provides plan participants (employees) with a menu of investment options, and plan participants decide how to allocate their money among those options.101Jill E. Fisch & Tess Wilkinson-Ryan, Why Do Retail Investors Make Costly Mistakes? An Experiment on Mutual Fund Choice, 162 U. Pa. L. Rev. 605, 606 (2014). Under ERISA and DOL regulations, retirement plans are subject to a complex set of rules regarding investment selection, plan design, and the obligations of employers in interacting with plan assets.102Id. at 614–17.

ERISA applies trust law to the management of retirement accounts, with plan sponsors held to stringent fiduciary duties.103ERISA § 403, 29 U.S.C. § 1103(a). These fiduciary duties are commonly enforced through private class-action litigation. George S. Mellman & Geoffrey T. Sanzenbacher, Ctr. for Ret. Rsch., 401(k) Lawsuits: What Are the Causes and Consequences? (2018), https://crr.bc.edu/wp-content/uploads/2018/04/IB_18-8.pdf [perma.cc/76H2-CAKU]. Under section 404 of ERISA, fiduciaries for employee benefit plans, including retirement plans, must act prudently to minimize risk to investors, including by diversifying plan assets.104ERISA § 404, 29 U.S.C. § 1104(a). Fiduciaries must also act “solely in the interest” of plan participants for the purpose of “providing benefits to participants and their beneficiaries.”105Id. These obligations track trust law’s fiduciary duties of loyalty and care.106See, e.g., Schanzenbach & Sitkoff, supra note 1, at 399–400 (explaining relevant fiduciary principles under trust law).

Whether ERISA fiduciaries can properly include ESG funds in retirement plans has been the subject of ongoing debate, one premised largely on the question of whether taking nonpecuniary criteria into account is consistent with ERISA’s mandate.107See id. Different presidential administrations have taken different approaches with respect to whether ESG investing is consistent with ERISA fiduciary duties.

Starting in 1994, the DOL addressed the issue of “economically targeted investments” (ETIs), defined as “investments selected for the economic benefit they create apart from their investment return to the employee benefit plan.”108Interpretive Bulletin Relating to the Employee Retirement Income Security Act of 1974, 59 Fed. Reg. 32,606, 32,607 (June 23, 1994). The DOL explained that while fiduciaries need to act “solely in the interest of the plan’s participants and beneficiaries and for the exclusive purpose of providing benefits to their participants and beneficiaries,” the “fiduciary standards applicable to ETIs are no different than the standards applicable to plan investments generally.”109Id. That meant that as long as the ETI investment was as good as other options available to the plan, it could be prudently chosen. A plan could not, however, accept lower economic returns to pursue collateral benefits.

The DOL’s guidance on what is now called ESG investing turned more negative in 2008.110See Interpretive Bulletin Relating to Investing in Economically Targeted Investments, 73 Fed. Reg. 61,734 (Oct. 17, 2008). In a 2008 interpretive bulletin, the DOL stated that “ERISA’s plain text does not permit fiduciaries to make investment decisions on the basis of any factor other than the economic interest of the plan.”111Id. at 61,735. As a result, a fiduciary that weighed collateral benefits when choosing an investment risked breaching its fiduciary duties to the plan. The sole exception, in view of the DOL, was if after “examin[ing] the level of diversification, degree of liquidity, and the potential risk/return” of prospective investments, the fiduciary deemed “two or more investment alternatives” to be “of equal economic value to a plan,” in which case the fiduciary was permitted to factor in the noneconomic benefits as a tiebreaker.112Id. The bulletin required, in such a case, that the choice “be documented in a manner that demonstrates compliance with ERISA’s rigorous fiduciary standards.” Id. at 61,734. The bulletin’s approach reflected the then-prevailing view that considering ESG factors might benefit society generally but would usually come at the expense of returns.113U.S. Gov’t Accountability Off., GAO-18-398, Retirement Plan Investing: Clearer Information on Consideration of Environmental, Social, and Governance Factors Would Be Helpful 2, 17–18 (2018).

In 2015, the DOL withdrew the stricter 2008 guidance and reinstated the 1994 articulation of the standard.114Interpretive Bulletin Relating to the Fiduciary Standard Under ERISA in Considering Economically Targeted Investments, 80 Fed. Reg. 65,135, 65,136 (Oct. 26, 2015). In so doing, the DOL emphasized that just because an investment is an ETI or ESG investment does not mean that the investment is “inherently suspect or in need of special scrutiny.”115Id. A “fiduciary may not use plan assets to promote social, environmental, or other public policy causes at the expense of the financial interests of the plan’s participants and beneficiaries,”116Id. at 65,135. but may consider ESG investments that provide equal economic value without drawing special scrutiny or incurring paperwork obligations.

A field assistance bulletin in 2018 “clarified” the 2015 guidance by offering new—and more negative—guidance on how plans can consider ESG factors.117U.S. Dep’t of Lab., Field Assistance Bull. No. 2018-01 (2018), https://www.dol.gov/sites/dolgov/files/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2018-01.pdf [perma.cc/GB8R-S8AR]. The bulletin warned that an ERISA fiduciary’s use of ESG factors must “be appropriate to the relative level of risk and return involved compared to other relevant economic factors.”118Id. at 2. Reflecting the increasingly accepted view that ESG factors can be relevant to risk and return, the 2018 guidance acknowledged that “ESG issues [can] present material business risk[s] or opportunities.”119Id. The guidance noted that if a fiduciary deems ESG factors to “present material business risk[s] or opportunities,” then those factors “should be considered by a prudent fiduciary along with other relevant economic factors to evaluate the risk and return profiles of alternative investments.”120Id.

In 2020, the DOL raised the stakes by engaging in rulemaking rather than subregulatory guidance.121Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 39,113 (proposed June 30, 2020) (to be codified at 29 C.F.R. pt. 2550). Its proposed rule, issued on June 30, 2020, took a decidedly negative view of ESG funds. The DOL wrote in the preamble that “[a]s ESG investing has increased, it has engendered important and substantial questions and inconsistencies, with numerous observers identifying a lack of precision and rigor in the ESG investment marketplace”122Id. at 39,115. and said flatly that “ESG investing raises heightened concerns under ERISA.”123Id.

The DOL pointed to the inconsistencies among ESG ratings,124See supra Section I.A. which it described as “vague,” to argue that “[t]here is no consensus about what constitutes a genuine ESG investment.”125Financial Factors in Selecting Plan Investments, 85 Fed. Reg. at 39,115. The DOL also pointed to the cost of ESG funds, stating that “ESG funds often come with higher fees[] because additional investigation and monitoring are necessary to assess an investment from an ESG perspective.”126Id. The DOL cited the SEC’s request for comment on the Names Rule as evidence of the “questions and inconsistencies” plaguing the ESG space.127Id.

Most importantly, the DOL highlighted the concern that ESG funds might be affirmatively inferior to non-ESG funds from a pecuniary perspective:

[I]n the case of some ESG investment funds being offered to ERISA defined contribution plans, fund managers are representing that the fund is appropriate for ERISA plan investment platforms, while acknowledging in disclosure materials that the fund may perform differently or forgo certain opportunities, or accept different investment risks, in order to pursue the ESG objectives.130F128Id. at 39,116.

The DOL’s proposed response to these concerns was to reiterate that a plan may not subordinate risk and return to achieve collateral benefits outside the plan. The proposed rule explicitly stated:

Plan fiduciaries are not permitted to sacrifice investment return or take on additional investment risk to promote non-pecuniary benefits or any other non-pecuniary goals. Environmental, social, corporate governance, or other similarly oriented considerations are pecuniary factors only if they present economic risks or opportunities that qualified investment professionals would treat as material economic considerations under generally accepted investment theories. The weight given to those factors should appropriately reflect a prudent assessment of their impact on risk and return.131F129Id. at 39,127 (emphasis added). The proposed rule also would have imposed significant new documentation requirements on fiduciaries using collateral benefits as a tiebreaker. See id. (requiring the fiduciary to “document specifically why the investments were determined to be indistinguishable and document why the selected investment was chosen based on the purposes of the plan, diversification of investments, and the interests of plan participants and beneficiaries in receiving benefits from the plan”).

The rule would also have barred “environmental, social, corporate governance, or similarly oriented”130Id. funds from being used as default options in 401(k) plans, though such funds were still permissible if their inclusion was based only on “objective risk-return criteria, such as benchmarks, expense ratios, fund size, long-term investment returns, volatility measures, investment manager investment philosophy and experience, and mix of asset types” in selecting options for the plan.131Id. In short, the DOL’s proposed rule would have subjected ESG investments to heightened scrutiny for potential fiduciary breach.

The proposed rule’s skepticism toward ESG funds was met with withering criticism from most of the asset management industry.132Julie Gorte et al., Public Comments Overwhelmingly Oppose Proposed Rule Limiting the Use of ESG in ERISA Retirement Plans (2020), https://www.ussif.org/Files/Public_Policy/DOL_Comments_Reporting_FINAL.pdf [perma.cc/9TKD-E2WG] (observing that the proposal garnered more than eight thousand comments). Three months later, on November 13, 2020, the DOL adopted a substantially modified final rule.133Financial Factors in Selecting Plan Investments, 85 Fed. Reg. 72,846 (Nov. 13, 2020) (to be codified at 29 C.F.R. pt. 2509, 2550). Significantly, the new rule removed all explicit discussion of ESG considerations and dropped the requirement that ESG funds not be used as qualified default investment alternatives.134Joseph Lifsics, The Department of Labor’s ESG-less Final ESG Rule, Harv. L. Sch. F. on Corp. Governance (Nov. 24, 2020), https://corpgov.law.harvard.edu/2020/11/24/the-department-of-labors-esg-less-final-esg-rule [perma.cc/NDK6- Z7UT]. The revised version still emphasized the need for fiduciaries to base investment decisions on pecuniary factors and, as a result, poses some risk to the ESG investment space.135In addition, the DOL’s skepticism of ESG investing survived in the preamble to the final rule. See Financial Factors in Selecting Plan Investments, 85 Fed. Reg. at 72,847–48; see also Karina Karakulova, DOL Finalizes Rule on ESG Investing: Is “Nonpecuniary” a Synonym for “ESG”?, CFA Inst.: Mkt. Integrity Insights (Dec. 2, 2020), https://blogs.cfainstitute.org/marketintegrity/2020/12/02/dol-finalizes-rule-on-esg-investing-is-nonpecuniary-a-synonym-for-esg [perma.cc/D5K6-N4GB] (“[T]he Department reiterates throughout the preamble to the final rule its numerous concerns about the ‘growing emphasis on ESG investing[] and other nonpecuniary factors’ . . . .”). By focusing investment choice on pecuniary factors, it may be difficult for funds to rely on ESG ratings unless all the criteria underlying those ratings are pecuniary in nature.136See Karakulova, supra note 135 (“[I]ndustry participants remain concerned about [the rule’s] chilling effect on ESG investing and factor integration, as well as about the integrity of the rulemaking process.”).